Publications

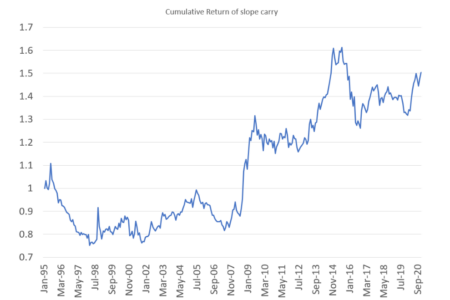

Concealed Carry

Journal of Financial Economics (2023)

Volatility Risk Pass-Through

Review of Financial Studies (2022)

|

We produce novel empirical evidence on the relevance of output volatility (vol) shocks for both currency and international quantity dynamics. Focusing on G-17 countries, we document that: (1) consumption and output vols are imperfectly correlated within countries; (2) across countries, consumption vol is more correlated than output vol; (3) the pass-through of relative output vol shocks onto relative consumption vol is significant, especially for small countries; and (4) consumption differentials vol and exchange rate vol are disconnected. We rationalize these findings in a frictionless model with multiple goods and recursive preferences featuring a novel and rich risk-sharing of vol shocks. (with M. Croce, Y. Liu, Ivan Shaliastovich) |

|||||||||||||||

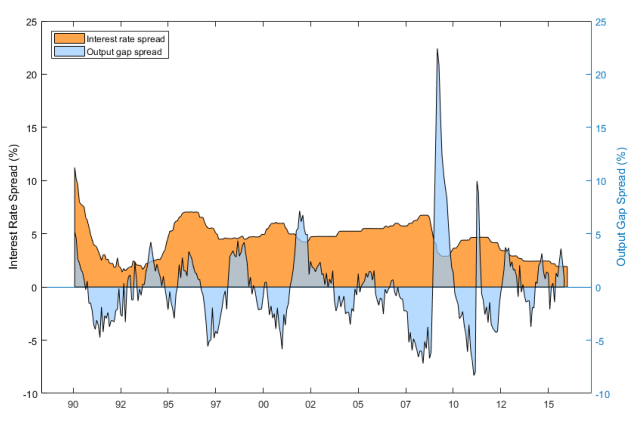

Business Cycles and Currency Returns

Journal of Financial Economics (2020)

|

We find a strong link between currency excess returns and the relative strength of the business cycle. Buying currencies of strong economies and selling currencies of weak economies generates high returns both in the cross section and time series of countries. These returns stem primarily from spot exchange rate predictability, are uncorrelated with common currency investment strategies, and cannot be understood using traditional currency risk factors in either unconditional or conditional asset pricing tests. We also show that a business cycle factor implied by our results is priced in a broad currency cross section. (with S. Riddiough and L. Sarno) |

||||||||||||||||

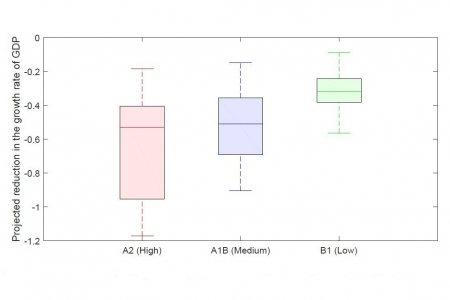

Temperature and Growth: a Panel Analysis of the United States

Journal of Money, Credit, and Banking (2019)

|

We document that seasonal temperatures have significant and systematic effects on the U.S. economy, both at the aggregate level and across a wide cross-section of economic sectors. This effect is particularly strong for the summer: a 1oF increase in the average summer temperature is associated with a reduction in the annual growth rate of state-level output of 0.15 to 0.25 percentage points. We combine our estimates with projected increases in seasonal temperatures and find that rising temperatures could reduce U.S. economic growth by up to one-third over the next century. (with B. Hoffmann and Toan Phan) |

||||||||||||||||||

The Term Structures of Coentropy in International Financial Markets

Management Science (2019)

|

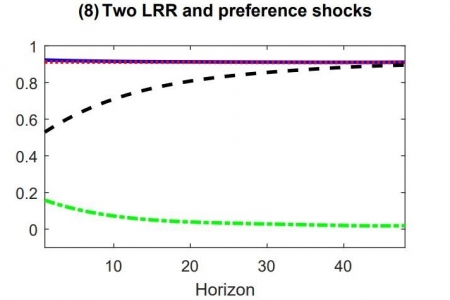

We propose a new entropy-based correlation measure (coentropy) to evaluate the performance of international asset pricing models. Coentropy captures the codependence of two random variables beyond normality. We document that the coentropy of international stochastic discount factors (SDFs) can be decomposed into a series of entropy-based correlations of permanent and transitory components of the SDFs. We employ the cross section of G-10 countries to obtain model-free estimates of all the components of coentropy at various horizons and we show that the generalization of the long-run risk model featuring two predictable components of consumption growth rates, global disasters, and recursive preferences can account for the composition of codependence at all horizons. (with F. Chabi-Yo)

|

||||||||||||||||

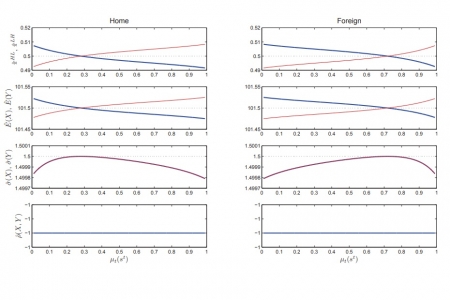

Recursive Allocations and Wealth Distribution with Multiple Goods: Existence, Survivorship, and Dynamics

Quantitative Economics (2019)

|

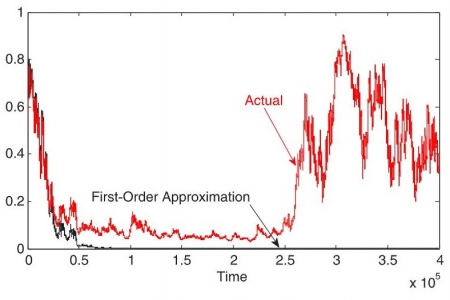

We characterize the equilibrium of a complete markets economy with multiple agents featuring a preference for the timing of the resolution of uncertainty. Utilities are defined over an aggregate of two goods. We provide conditions under which the solution of the planner’s problem exists, and it features a non-degenerate invariant distribution of Pareto weights. We also show that perturbation methods replicate the salient features of our recursive risk-sharing scheme, provided that higher-order terms are included. (with Croce and Liu) |

||||||||||||||||

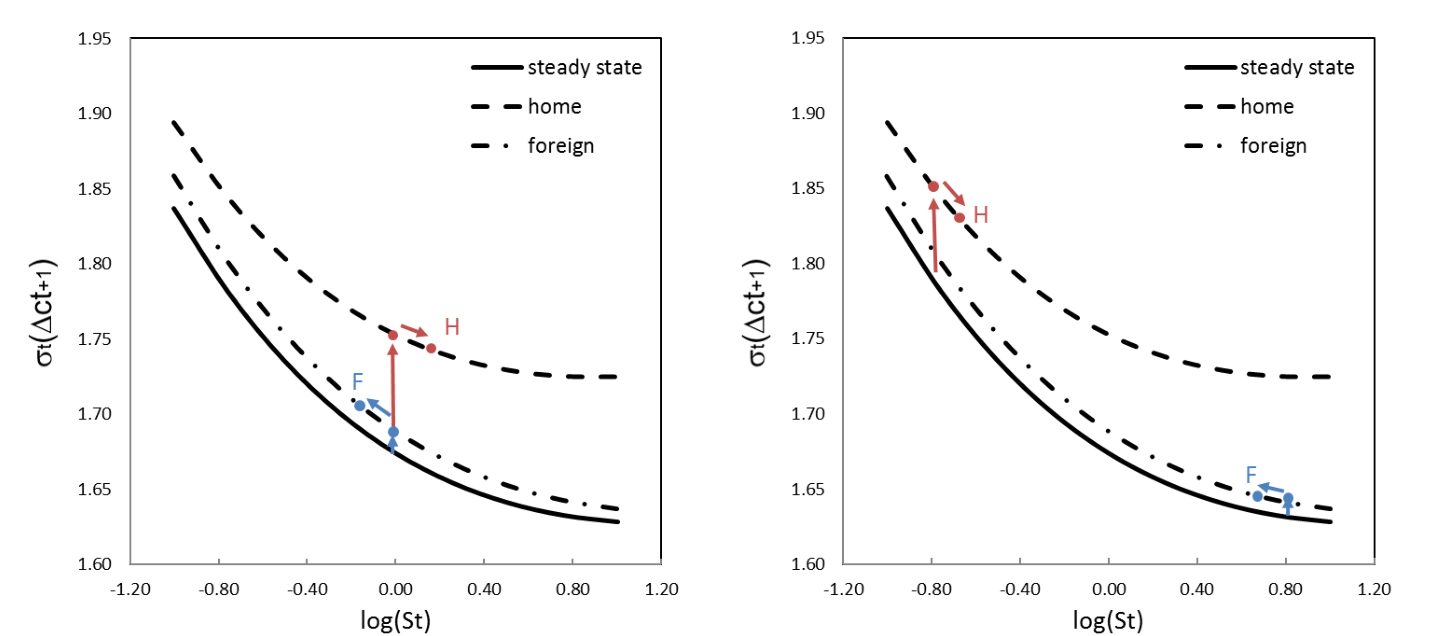

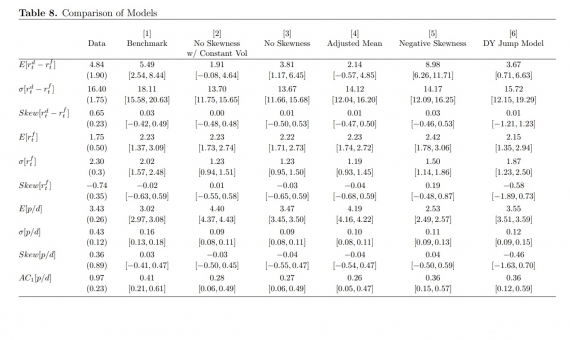

Currency Risk Factors in a Recursive Multi-Country Economy

The Journal of Finance (2018)

|

We study a risk-sharing model featuring multiple countries with recursive preferences defined over bundles of consumption goods whose supply is subject to both global and local short- and long-run shocks. First, we quantify the extent of contagion and insurance possibilities as we vary the number of countries in the economy. Second, we introduce persistent heterogeneous exposure to global long-run news shocks and analyze the properties of several carry trade strategies in the context of our model (Lustig et al. 2011 HML-FX, and Della Corte et al. (2013) HML-NA). (with M. Croce, F. Gavazzoni, R.Ready) |

||||||||||||||||

|

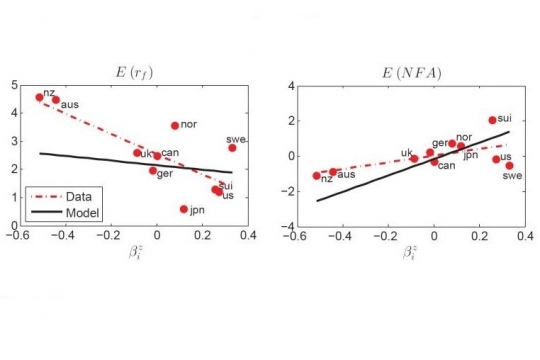

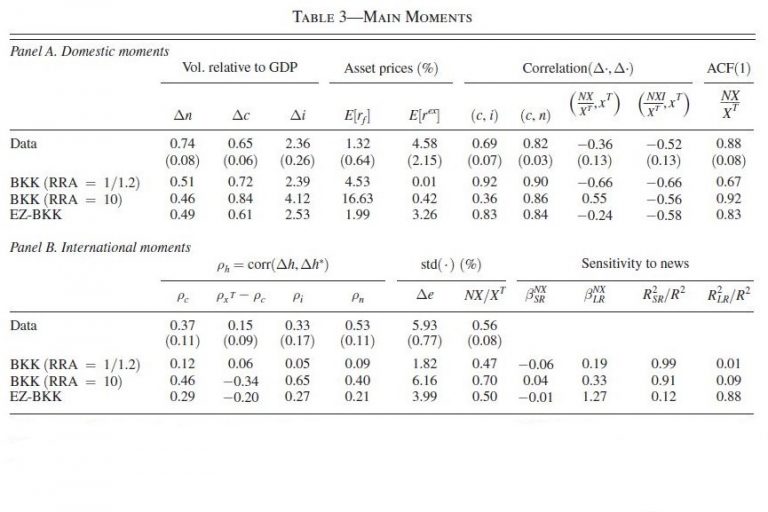

We study the response of international investment flows to short- and long-run growth news. Among developed G7 countries, positive long-run news for domestic productivity induces a net outflow of investments, in contrast to the effects of short-run growth shocks. We document that a standard Backus, Kehoe, and Kydland (1994) (BKK) model fails to reproduce this novel empirical evidence. We augment this model with Epstein and Zin (1989) preferences (EZ-BKK) and characterize the resulting recursive risk-sharing scheme. The response of international capital flows in the EZ-BKK model is consistent with the data. (with Max Croce, Steven Ho, and Philip Howard) |

||||||||||||||||

Skewness in Expected Macro Fundamentals and the Predictability of Equity Returns: Evidence and Theory

Review of Financial Studies (2016)

|

We show that introducing time-varying skewness in the distribution of expected growth prospects in an otherwise standard endowment economy can up to double the model implied equity Sharpe ratios, and produce a substantial amount of fluctuation in equity risk premia. Looking at the Livingston Survey, we document that the first and third cross-sectional moments of the distribution of GDP growth rates made by professional forecasters can predict equity excess returns, a finding which is consistent with our consumption based asset pricing model. (with Eric Ghysels, Jinghan Meng, and Wasin Siwasarit). |

|||||||||||||||||

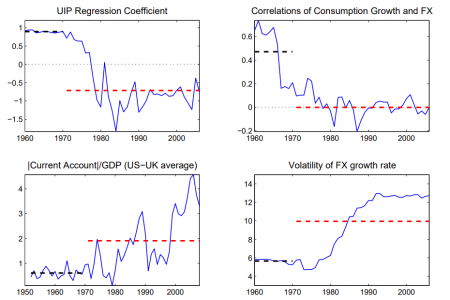

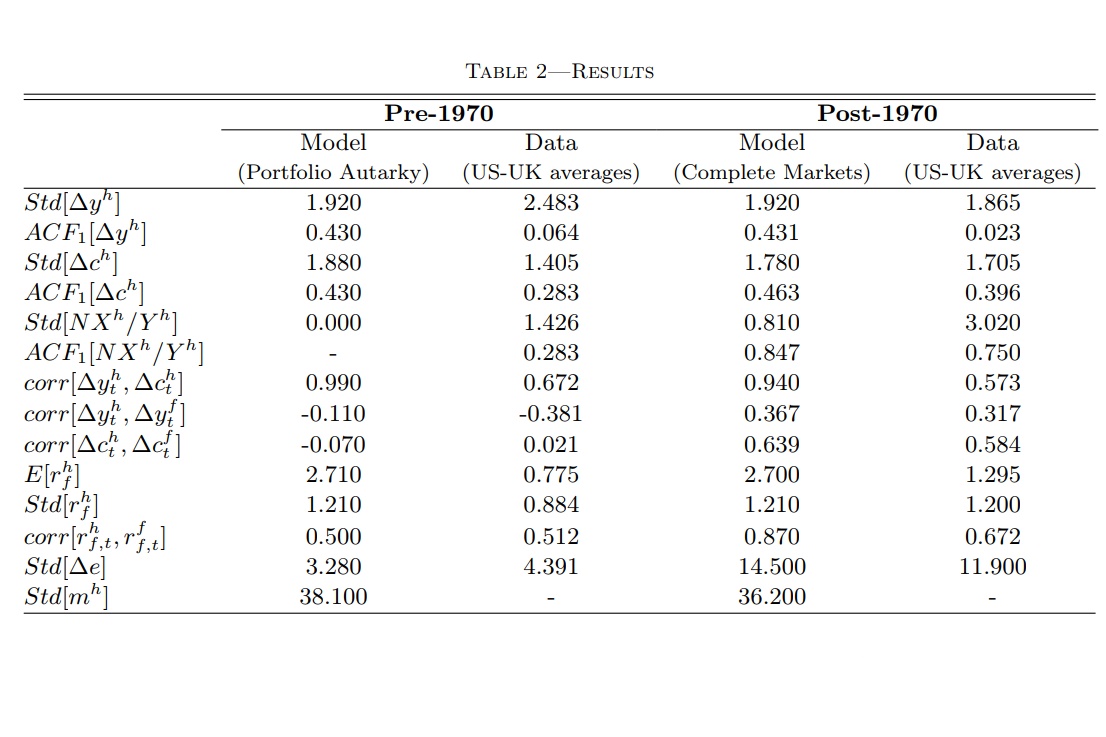

International Asset Pricing with Recursive Preferences

The Journal of Finance (2013)

|

Focusing on US and UK, we document that both the Backus and Smith finding—concerning the low correlation between consumption differentials and exchange rates—and the forward-premium anomaly—concerning the tendency of high interest rate currencies to appreciate—have become more severe through time. After accounting for different capital mobility regimes, we show that these anomalies turn into general equilibrium regularities in a two-country and two-good economy with Epstein and Zin preferences, frictionless markets, and correlated long-run growth prospects. (with Max Croce) |

||||||||||||||||

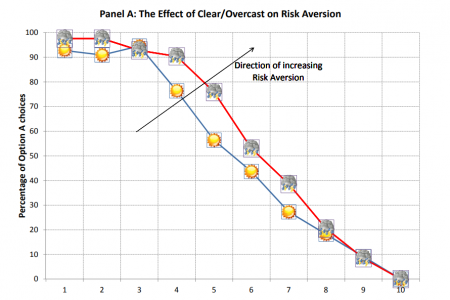

O’ Sole Mio: An Experimental Analysis of Weather and Risk Attitudes in Financial Decisions

Review of Financial Studies (2013)

|

Although weather has been shown to affect financial markets and financial decision making, a still open question is the channel through which such influence is exerted. By employing a multiple price list method, this paper provides direct experimental evidence that sunshine and good weather promote risk-taking behavior. This effect is present whether relying on objective measures of meteorological conditions or subjective weather assessments. Finally, employing a psychological test, we find evidence that weather may affect individual risk tolerance through its effect on mood. (with Anna Bassi and Paolo Fulghieri) |

|

|||||||||||||||

International Robust Disagreement

The American Economic Review Papers & Proceedings (2012)

|

We characterize the equilibrium of a two-country, two-good economy in which agents have opposite bias toward one of the two consumption goods and fear model misspecification. We document that disagreement about endowments’ growth prospects is a natural outcome of this class of economies. (with Max Croce) |

||||||||||||||||

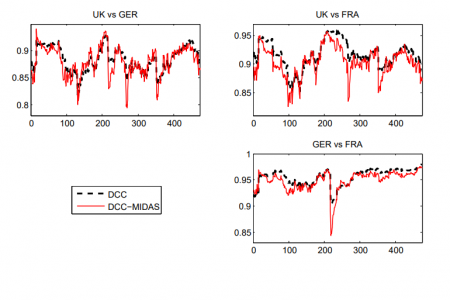

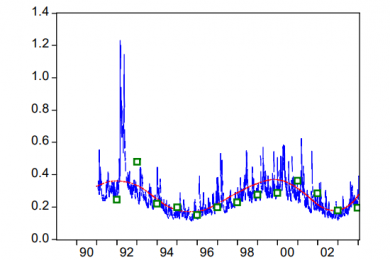

A component model for dynamic correlations

Journal of Econometrics (2011)

|

The idea of component models for volatility is extended to dynamic correlations. We propose a model of dynamic correlations with a short- and long-run component specification. We call it the class of models DCC-MIDAS as the key ingredients are a combination of the Engle (2002) DCC model, the Engle and Lee (1999) component GARCH model to replace the original DCC dynamics with a component specification and the Engle, Ghysels, and Sohn (2006) GARCH-MIDAS component specification that allows us to extract a long-run correlation component via mixed data sampling. We provide a comprehensive econometric analysis of the new class of models, including conditions for positive semi-definiteness, and provide extensive empirical evidence that supports the model specification. (with Robert Engle and Eric Ghysels) |

||||||||||||||||

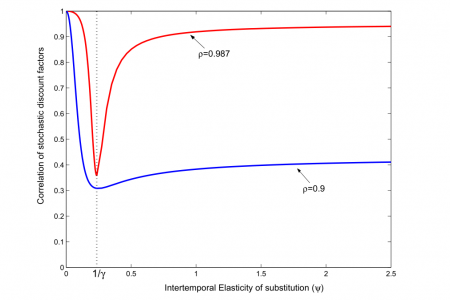

Risks for the long run and the real exchange rate

Journal of Political Economy (2011)

|

Brandt, Cochrane, and Santa-Clara (2004) point out that the implicit stochastic discount factors computed using prices on the one hand and consumption growth on the other hand have very different implications for their cross country correlation. They leave this as an unresolved puzzle. We explain it by combining Epstein and Zin (1989) preferences with a model of predictable returns and by positing a very correlated long run component. We also assume that the intertemporal elasticity of substitution is larger than one. This setup brings the stochastic discount factors computed using prices and quantities close together, by keeping the volatility of the depreciation rate in the order of 14% and the cross country correlation of consumption growth around 30%. (with Max Croce) |

||||||||||||||||

The short- and long-run benefits of financial integration

American Economic Review Papers & Proceedings (2010)

|

Cole and Obstfeld (1991) pointed out that the welfare benefits of international portfolio diversification might be negligible. They obtain this result in the context of a model in which agents have time-additive constant relative risk aversion preferences. We revisit their conclusion by showing that a preference for the timing of the resolution of uncertainty combined with endowments containing a slowly moving trend can result in extremely high welfare gains. (with Max Croce) |

||||||||||||||||

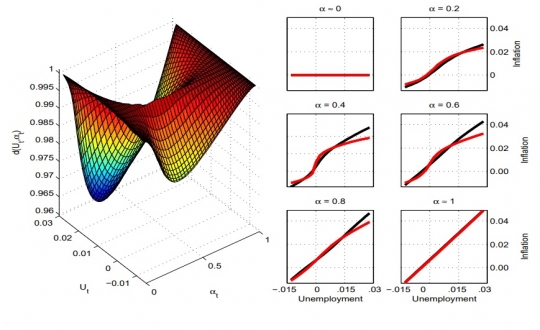

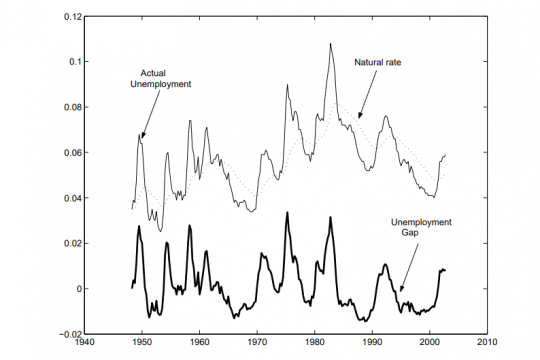

Robustness and US Monetary Policy Experimentation

Journal of Money, Credit, and Banking (2008)

|

We study how a concern for robustness modifies a policy maker’s incentive to experiment. A policy maker has a prior over two submodels of inflation-unemployment dynamics. One submodel implies an exploitable trade-off, the other does not. Bayes’ law gives the policy maker an incentive to experiment. The policy maker fears that both submodels and prior probability distribution over them are misspecified. We compute decision rules that are robust to misspecifications of the dynamics posited by each submodel as well as the prior distribution over submodels. We compare robust rules to ones that Cogley, Colacito, and Sargent (2007) computed assuming that the models and the prior distribution are correctly specified. We explain why the policy maker’s desires to protect against misspecifications of the submodels, on the one hand, and misspecifications of the prior over them, on the other, have different effects on the decision rule. (With Tim W. Cogley, Lars Peter Hansen and Tom J. Sargent) |

||||||||||||||||

Term structure of risk, the role of Known and Unknown Risks and Non-stationary Distributions

The Known, the Unknown and the Unknowable in Financial Risk Management

|

In this paper we document the presence of a time structure of risk and we propose how to measure it using alternative models to forecast volatility and the VaR at different horizons. We then quantify the benefits of an investor that is aware of the existence of a term structure of risk in the context of an asset allocation exercise. (With Robert Engle) |

||||||||||||||||

Benefits from U.S. Monetary Policy Experimentation

Journal of Money, Credit, and Banking (2006)

|

A policy maker knows two models of inflation-unemployment dynamics. One implies an exploitable trade-off. The other does not. The policy maker’s prior probability over the two models is part of his state vector. Bayes law converts the prior into a posterior at each date and gives the policy maker an incentive to experiment. For a model calibrated to U.S. data through the early 1960s, we isolate the component of government policy that is due to experimentation by comparing the outcomes from two Bellman equations, the first of which embodies a `experiment and learn’ setup, the second of which embodies a `don’t experiment, do learn’ view. We interpret the second as an example of an `anticipated utility’ model and study how well its outcomes approximate those from the `experiment and learn’ Bellman equation. (With Tim Cogley and Tom Sargent) |

||||||||||||||||

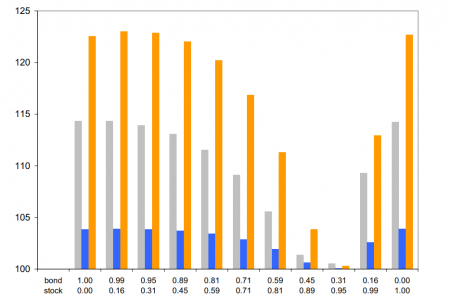

Testing and valuing dynamic correlation for asset allocation

Journal of Business and Economic Statistics (2006)

|

We evaluate alternative models of variances and correlations with an economic loss function. We construct portfolios to minimize predicted variance subject to a required return. It is shown that the realized volatility is smallest for the correctly specified covariance matrix for any vector of expected returns. A test of relative performance of two covariance matrices is based on Diebold and Mariano (1995). The method is applied to stocks and bonds and then to highly correlated assets. On average dynamically correct correlations are worth around 60 basis points in annualized terms but on some days they may be worth hundreds. (With Robert F. Engle) |

||||||||||||||||